2010 Market Update and Outlook, Part II - Global Health

Considering what's occurred in the last few days, this update could probably have been a bit sooner...

Fundamentally, there are two conditions in play that are going to weigh on both global equities and commodities:

1. China's concern with domestic inflation and a need to cool their economy

2. Debt and default risk in the PIIGS countries of Portugal, Ireland, Italy, Greece (especially) and Spain

Mark Faber touched on these conditions in our last post.

Recently, the notable risk in Greek debt has negatively impacted the euro and caused a return of the dollar rally. Through correlation, even though most companies are beating earnings expectations, the US equity markets have been negative (rising dollar), and most global markets tend to follow US markets. The additional pressure from China seeking to slow growth has added further downward pressure on commodity prices--more on that tomorrow.

To review the equity market, we must review the currency situation and update our global health review.

Let's start with the euro as an indicator of the dollar's direction.

Below is a three year daily chart of the euro against the US dollar. It may be difficult to see (look at a 6 month chart for better visibility), but the euro has formed a downward flag with the pole beginning at the 1.51 level, the flag extending from the 1.42 to 1.46 levels, and now it has broken down. The target for that patterns should be around the 1.36 level. With that said....

In the short term, the RSI is approaching oversold, the slow stochastic is oversold, and the euro is a psychological support of 1.40. We can expect a short term rebound in the euro, likely to 1.42. A sustained break above 1.42 implies the euro trend is moving positive, but we don't expect to get there until we see the 1.36-1.38 level.

What's the impact on the dollar?

In the short term, we expect the dollar rally to cool a bit as the euro climbs and it approaches overbought. In the intermediate term, the dollar may rally as far as 80 on the USDX, depending on the extent of the euro's troubles. Fundamentally, the eurozone needs to deal with the debt default issues of the PIIGS, but given the structural design of the EU, it is simply not easy to do. The EU is not a nation. It has limited control over individual countries. Thus, there is some significant risk here. If, for example, Greece were to default, what would stop other first world, debt laden countries like Italy, Ireland, Spain, Portugal, Dubai, or the US from doing the same? Frankly, that's economic destruction on a massive scale and the world cannot tolerate such an event without significant risks to international stability. Thus, the EU is left trying to figure out how to solve the problem without having the authority to do anything. That's a difficult situation, and we do not perceive an easy way out. If the other EU nations shoulder the burden of the PIIGS, then the euro will be a worse currency than the dollar (it becomes a eurozone problem, not a Greece problem, which is not likely to make the French, Germans, etc very happy), which will strengthen the dollar and kill any chance of any economic recovery (which is being led now by US exports), which will greatly damage any global recovery. By proxy, we expect some congenial way of the PIIGS being removed from the greater EU. There seems to be no other way.

In summary, this feeds into our 2010 outlook of increased volatility as the globe faces increased competition for currencies racing to the bottom. On one hand, we have the institutional belief that the only thing that can drive global recovery is devaluation of currency (ie, fight a debt deflation by inflating currency) which improves exports. On the other hand, central banks are becoming nervous about the inflationary outcomes and are withdrawing liquidity. As they do this, their economies will flounder and other countries will gain momentum in their exports, forcing every country to again inflate their currency. This tighten/loosen/compete to weaken currency/react to tame inflation sine wave will cause significant whipsawing of currency markets as slowly but surely, these countries absolutely destroy their currencies. The death of fiat money comes closer and the impact will be increasingly volatile and violent in the markets.

The beneficiary of this, of course, will be tangible things--notably gold and silver. Although there is a deflationist contingency out there that believes gold will have to fall as debt crashes, we believe nothing could be further from the truth. The US can ill afford to allow the dollar to rise to astronomical levels without defaulting on its debt, which will effectively make the credit rating of the US "junk." Thus, the US must continue to print money and attempt to weaken the currency in a controlled fashion or national default will make the dollar worth zero in an uncontrolled fashion. In this circumstance, the only money worth holding is money with no liability--hence the reason gold is likely to outperform dramatically.

In the short term, as we stated last night, gold will likely rebound along with the euro. However, gold will probably retest in the intermediate term unless fear of sovereign defaults really grabs investor attention, at which point gold may simply "go to the moon."

Let's take a look at the global health picture, as a follow up to December's update.

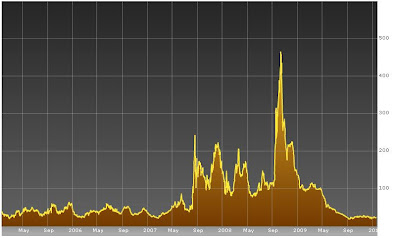

The TED spread continues to look good. First, a longer term picture for perspective, then a one month view, including today.

Note that the spread is generally holding steady under 24. There is no significant sign of credit stress.

Junk bonds are down, but nothing we haven't seen since March 2009 when the run began. We should hold just around the 50 day moving average if this bull market is to continue. What's important to note is that the rate of increase is declining (like in most equities and equity indices). Short term, we are approaching support and all of the indicators are showing that we should get some buying in or near here. Intermediate term is more of a question mark.

Similarly, corporate bonds don't appear to have any problems, but they probably have a bit more downside here than junk bonds. There is some concern about a head and shoulders top being set up, and LQD needs to stay above 102 to guarantee the bull's intact.

As we posted in December, we don't buy off on a steepening yield curve alone as a bearish indicator (please read the article for context) alone without another confirming signal or two. That said, we're paying close attention. Given the state of affairs, we'd prefer to not see a breakout.

The gold/silver ratio is still generally tilted in silver's favor (which is healthy on a global scale--it tilts in gold's favor when stress is at a maximum). Note that we're ticking up in the short term in favor of gold--watch the top end of the channel for a breakout--that would be bad. Ideally, we should bounce off of the top trendline and turn back down if global economic health is to be maintained.

Right now, it appears the S&P is barely hanging onto a key support level, and gold has bounced from the 1080 level that we were watching last night. We'll update the equity markets this weekend after the markets close. It's likely that there's more downside intermediate term, but a short term rally from this point (beginning next week after global markets move lower during Sunday night, US time) is probably in the carts. Gold has probably bottomed for now... Read more...