Dollar and Gold Market Update - A Look at the History of Dollar Countertrend Rallies and the RSI

We're going to start today's post a little differently by looking at our record--the good and the bad--as it applies to this move in the dollar and gold so as to set the stage for the purpose of this post on what to look for in a dollar turn based on its actions in the last 10 years of the bear market.

Note that we started talking about a need for gold to sell off technically, on November 4 with a need to consolidate near the 1100 number, or possibly as low as 1070. Of course, this call was early, but now that we're working around that number, it seems to make sense, right? By November 5, we were talking about sell signals on gold and the need to take profits. By November 10, we were discussing the long term (primary) trend and warning that gold needed a correction in the short term, and that if it didn't correct then, there would be an intermediate term correction of a higher than normal magnitude coming. By November 18, we discussed how gold was moving euphorically even as the euro did not confirm the move by failing to break 1.50 against the dollar. By November 20, we were looking at the bullish and bearish cases on the euro to determine what direction things were going, and commenting on the ECB talking the euro down. On November 25, we discussed that either gold was frothy or the dollar was about to take a nosedive--confirming we believed that gold was big time frothy. On December 4, we discussed the gold correction underway but did not believe the dollar would break its 50 day moving average (should have trusted our own advice more on that one). We also incorrectly believed that the euro would find support earlier than it has, but that was before all of the Greek default talk. On December 7, we postulated that this could be a currency intervention (we still tend to believe that given the magnitude of the moves). On December 11, we looked at key currency support levels, which frankly, haven't held as well as we'd believed it would. We also commented on gold moving into the range for traders, which is still the case, noting that the 1100 area was solid with a possible breakdown as low as 1070. Again, going back to the beginning of November that a consolidation must take place at 1100 or so. Fast forward a month or so and here we are. During that month, it was certainly concerning that we may have blown some calls, but in the end, the charts don't lie. In summary, we've been right on in knowing there had to be a gold consolidation, and by proxy the US dollar must have at least "stood still," but we underestimated both the gold buying euphoria and the level of the dollar move up. That's something we hope to correct today.

This brings up one key area in the realm of traders vs. investors. Investors, which are simply traders with longer time horizons from our perspective, should be focused on the primary trend and should not be concerned with getting the absolute bottom of a move--just a good value. The reason, of course, is that the closer one tries to call a bottom or top, the more likely the call is wrong. A trader needs to not only get a trend right, but he must get it right in many different time horizons and get it right repeatedly in order to profit. Essentially, his risk is higher as he has to enter and exit more trades, and thus get more decisions right. It's a trickier game, but knowing the techniques can help make even long term investors make better decisions.

Let's get into it. This was originally going to be part of our gold report since the dollar and gold are so tightly linked. The problem, however, is that we can't seem to get the gold report out the door. So instead, we'll summarize the dollar section here, and as we near a bottom, we'll follow up with the key gold analysis.

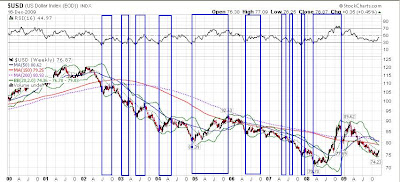

First, a history of the dollar in chart form since the beginning of the bear market.

The following are what we'll term "intermediate term" moves. Colors changed from blue to red to make it easier to see... Basically, just as the long term trend is made up of smaller periods we're terming the "longer term," so then is the longer term made up of yet smaller moves called "intermediate term" periods. All of these periods are also commonly referred to as "waves," but we're avoiding that term because it is often used by a specific school of technical analysis called "Elliott Wave Theory." We don't want to create confusion as if we're referring to their technique.

Of course the intermediate term moves are made up of short term moves. In a 10 year chart, there are simply too many to point out. But you probably get the idea by now.

Note that we're really trying to break this down to be more granular and specific than most. In most cases, analysts refer to the short term, intermediate term, and long term. However, each analyst has a slightly different definition of what that means. For our purposes, we're let the fundamentals drive the long term. The monthly charts confirm the long term and help define the longer term. The weekly charts define the intermediate term (with input from the monthly charts), and the short term will be defined by the daily charts (with input from the weekly charts). Sound confusing? It will become clearer as we move along.

Our primary means of investing is to invest in accordance with the long term trend, but to avoid the secondary (longer term) counter trend rallies by either changing assets or, in some cases, shorting the primary trend. We anticipated that the dollar would hit a longer term rally (a counter trend rally lasting several months that would be sharp and damaging to gold prices, in particular) in late Q1/2010 or early Q2/2010. There are several fundamental factors for that time period as well as technical indicators that have been trending to "go off" around that period since this March. However, we *may* be on the cusp of that longer term countertrend rally now. The key in watching the dollar is to determine if we are, indeed, entering a significant countertrend move, or if this move is more of an intermediate or short term move.

To summarize our position in the dollar and gold markets, at this stage, we believe we're seeing an intermediate term move--one that will last maybe 4-6 weeks, of which 2.5 are already behind us. Initially, we believed we'd be seeing a move of a couple of weeks at most, but we've understimated the weakness in the euro, and are still under the belief that we are probably witnessing a currency intervention timed for near the end of the year when gold prices were strongly overbought and the dollar was under significant pressure. Why? There are several factors, in fact, but perhaps the most important was is that this market has been trading very technically for a long time now, probably due to the dramatic rise in the computer-based trading instead of long term fundamental investing (hence the dollar vs. all assets in the world has been a theme even when the fundamentals don't support that in all cases). Given that, then we can look at one very important piece of information--the dollar has never had a major (longer term/secondary/counter trend) rally when it was not oversold on at least the daily and weekly charts, and at times the monthly charts. Never. Not once. Yet this time, all of the activity began occurring when the dollar was not oversold, but gold was overbought. Combine that with data from the Exchange Stabilization Fund, the time of the year (holiday season), the negative dollar press everywhere, the ECB talking the euro down and the dollar up, the Bank of Japan talking the yen down and the dollar up, the positive press on gold, etc and you have a formula for the perfect time to intervene and manage market perception going into Bernanke's confirmation when there were signs all over that the trend from March was slowing. Coincidence? Only if you believe that we have free markets....

Nevertheless, here's a fact (and the number one reason to include technical analysis in your investing)...though markets are manipulated, that manipulation *must* show up in the price of assets. There is no way, as an example, for central banks to beat the price of gold down without the price being affected. While this seems ridiculously obvious, the point is that since we're using price-based analysis, then as the price moves, we should be able to determine the price movement will have on investors, resulting in additional future price movements. That's the purpose of technical analysis and the reason that fundamentals alone, while they are the most critical aspect of investing, are not enough to navigate manipulated markets.

Another important note is deserved here. No long term trend can develop without longer term trends that develop. No longer term move can occur without intermediate term moves that become longer move. No intermediate term move can develop without short term moves. Everything starts at the daily, short term level and may or may not expand. Given this condition, calling bottoms and tops obviously becomes a fool's game because the implication is that on any given day, you must know whether or not a given market move is going to be a long term play or not. It's just not possible. Our goal, when trading, is simply to determine if trends are changing, and if so, what the duration of that trend may be. Then move into it once it has actually become a trend. We'll never get 100% of a trend's move, but we're happy to take 80% of a trend with much lower risk, getting in after it's established and getting out before the herd.

With all of that said and the stage set, then let's look at how well the RSI has forecast the dollar moves in the short, intermediate, longer, and long term and what the history of these moves tells us that could be used to improve our odds of looking into the future.

The first chart is a 10 year long monthly dollar chart. There are areas outlined in either red or blue. The blue outlines denote what we call "longer term" or countertrend moves.

In 10 years, there have been two countertrend periods, and both were forecast by the RSI. Take a look at the monthly chart again. Notice that the RSI was oversold (below 30) for an extended period of time before both rallies occurred.

There are two red boxes on those charts as well. They correspond to intermediate term rallies. You could say they were "false positives" that a longer term rally was coming. Note that those intermediate term rallies never really moved the RSI from bordering an oversold condition, so in the end, it took a longer term countertrend rally to move the oscillator to the 50 mark (which is an important level on the RSI that separates bear markets from bull markets). Note that in our latest period, the RSI is not oversold at all. The trend from March would have put the RSI into oversold in late Q1 or Q2/2010, which was part of the purpose of our thesis about the gold price moving up until that period in time (as the dollar weakened). Note on this chart that since the dollar entered its bear market in 2001 (which occurred when it topped and was technically confirmed in 2002 when the monthly RSI fell below 50), the RSI has not risen for any substantial amount of time above 50--only briefly and barely during the first major countertrend rally and again when the credit crisis (last rally) fueled the countertrend rally. We've discussed this issue in the Looking Back at Signs of the Credit Crisis essay and our recent Global Health update. In short, without credit stress, we do not believe that any countertrend dollar rally can substantially break above 50 on the monthly RSI for any reasonable period of time. Thus, that 50 mark takes on a different meaning--without an exogenous event fueling a dollar move, any break above 50 for a substantial period is a good technical confirmation of a primary trend change to a dollar bull market due to a change in fundamentals (ie, the US gets its fiscal house in order). We're not holding our collective breath on that one any time soon.

If we look at the RSI's performance on a weekly dollar chart over the same 10 years, we get a sense of the intermediate term rally picture. We pick out about 19 intermediate term rallies for the dollar in the last 10 years (counting the current one). If you used the RSI alone to forecast those rallies when the RSI was oversold only (as shown below), you'd have forecasted 11 of them (58%). You would have forecasted 100% of rallies of at least 5% magnitude in size.

If you would have used the RSI at every oversold and turn at 50, you'd have forecasted 13 of 19 (68%) and every rally of at least 3%. That's pretty good for one indicator. Note that this recent dollar rally was also forecast as the RSI just touched the 30 level on the weekly chart. That corresponded to the period when we first made the gold call that it was becoming overbought at 1100.

Note that the weekly and monthly charts were both oversold when the two longer term, countertrend rallies occurred.

Now, this doesn't mean that the RSI is the Holy Grail of technical analysis. It is very good, though, and the dollar has been particularly predictable with it. Gold tends to need the slow stochastic, stock markets tend to need an advance/decline, etc. There is no single indicator that forecasts everything, and they tend to be best as confirming indicators relative to chart patterns. However, the point here is that the RSI alone can help predict the dollar market, which in turn helps predict stocks, gold, energy and other asset markets.

If we simply take the weekly dollar chart above and examine each of the 10 marked periods on daily charts, you will get a further sense of the magnitude and duration of the dollar moves. We will leave the close examination to the reader, but here they are in chronological order. Notice again that these are daily charts, and so you will see the short term moves in greater detail that make up the intermediate term moves.

The first intermediate term move was approximately two months long and made up of three short term countertrend moves of 13, 7, and 8 trading days. (For those familiar with Elliott Wave Theory, you'll see this patterns throughout the rest of the discussion).

These next two rallies occurred in a short period of time, so we've combined the view on one chart. The first rally was a very steep short term rally (of "medium" or intermediate size) of 8 trading days. Arguably, you could consider the second short term rally to be part of the first intermediate term rally, but since a new low was not set, we have not included it as such.

The second rally was an intermediate term rally of four short term countertrend rallies of 9, 9, 3, and 13 days, respectively.

The fourth rally was made up of 3 short term rallies of 10, 21, and 7 trading days, respectively. It lasted 4 months. Obviously, there is some judgment as to how to break up the short term rallies. This is the most simplistic viewpoint, and 21 trading days is at the far extreme of what we'd term "short term." In addition, 4 months is about as long term as an intermediate term trend can be. This one bordered "longer term" in duration and magnitude. There are no clear cut lines, but about 10% and 6 months would be the maximum "intermediate term" trend in our book.

This next intermediate term rally ("Rally Number 5") became the first longer term countertrend move, lasting 6 months and running to 13%. Arguably, this is a secondary countertrend move mad up of three intermediate term moves. Refer back to the monthly chart to see its overall size (which stands out on the monthly chart) and the weekly chart (to see the four distinctive intermediate trend moves, each made up of short term countertrend rallies, as seen below).

The next intermediate term rally was made up of three short term rallies.

The next three occurred close together and are on the same chart. Notice that in this period, the monthly RSI was still staying in the oversold range, and the weekly RSI was hugging the oversold level (much as occurred prior to the first longer term rally). These rallies never really removed the oversold condition on the dollar.

The last dollar rally was a throwover from the prior three. Add in a little credit crisis, and look out! A 25% move over 6 months that went from a consolidation, to an intermediate term rally, to a longer term rally.

Thus, in 10 years, we have two longer term, counter trend rallies which were predicted by both the weekly and monthly RSI, nineteen countertrend rallies of which all of consequence were predicted by the RSI, and more short term rallies we care to count, many of which were predicted by the RSI and most of which were, frankly, inconsequential (look at the first 10 year daily chart we posted to get a better sense of it).

What can this data tell us about this current rally? First, the dollar was NOT oversold on the monthly charts and had only "tapped" the oversold line on the weekly charts when the rally began. History says that this will not be a longer term rally, implying that the dollar move will be less than 10% and four months or less in duration. The dollar has already moved more than a short term move would imply. With confidence, we can state this will be an intermediate term dollar move. Using the same exercise we went through and a similar one using gold as a proxy to determine when the dollar rallies end, we can conclude this move is probably over halfway done. The euro charts appear to confirm this activity, though it's possible more downside in the euro remains.

We have a high degree of confidence that, since this is an intermediate term rally without a monthly oversold RSI or a credit crisis situation, that we will have turn no later than when the weekly RSI just peaks over the 50 line and the daily RSI gets to just below the 70 line. We're just about there on both charts, meaning this run is just about over by historical measures. The implication is that we'll see gold bottom and turn up first as a forecast that the dollar is soon to turn over. In closing out the discussion around the gold price, we take you back to the December 4 forecast, and the final chart.

That initial forecast stands that gold has likely bottomed in the 1100 range, but there's a chance that we could have a breakdown to 1070. If that occurs, back up the truck because someone gave you the best discount you'll likely ever see again.

For the record, a similar analysis of the gold market shows that any time the 14 day slow stochastic reaches oversold, it's a good time to buy gold. We'll leave that investigation to the inquisitive readers. Read more...