We recently discussed staying on the right side of the trade by watching the 150 day moving average. Given the chaos of the last week or so in equity markets, the question is whether or not we've resumed the bear market or whether this is just a pullback in the bull market with more room to run. Today, we'll try and answer that question and provide some checkpoints to guide along the way. At this stage, it's not clear. For the intermediate term, there is a lot of technical damage. In the short term, after today's market action, we're probably poised for some degree of rally. Monday will confirm or deny this position. If the markets move back down and are particularly weak intraday, then we're set up for a crash. If the markets move flat to up with positive intraday signals, then we're likely to get at least a short term rally toward 1125 on the S&P. That level is absolutely critical, though not obvious on the charts. We're going to show why we believe that 1125 is the key to determining whether the intermediate term future holds a bull or bear market. In the long term, it's a mess....

Today's post will be CHART HEAVY. It is strongly encouraged that you click on each chart, blow it up, print it out, and study it relative to where we are today. Typically, we show charts with standard price based technical analysis showing the likely direction things will evolve. In this blog, we're going to "open the kimono" so to speak, and show some proprietary indicators that we use to help gauge the market action. You won't be disappointed.

Let's examine some evidence to see where we are.

This bull market began in March of 2009. The average bull market rally within a secular bear market lasts 22 months. That's an average. We doubt this rally will last that long in the best case. But, assuming we did get to the average timeframe, that implies that the bull market would end in January 2011.

Although the bullish sentiment at the top was ridiculously high, sentiment turned negative immediately as the "mini crash" began. This implies that the "bulls" out there don't have much conviction and are willing to sell at the drop of a hat. That, in and of itself, is bullish to some extent.

As we noted a couple weeks ago, we have our first indicator that a top is likely within 4-7 months. At this stage, we've only received a single signal. Past bear markets have posted a combination of signals from the same indicator: first a top, then a divergence vs. the general direction of the market, then a lower high just as the market turns under a flat to negative 150 day moving average.

Market breadth on up moves has been good since the rally began. So has on-balance volume (a technical measure of volume that tracks volume moves relative to up and down days). Absolute volume has been bearish--poor on up days, strong on down days.

From an investor standpoint, retail investors (that is, individual investors) are usually the patsies that get left holding the bag in major market moves. They tend to buy when things are moving up and sell when things start moving down--that is, they buy high and sell low. The major market makers know this and use their considerably larger pools of capital to "paint the tape" and pull retail investors to go long (and sometimes short, but retail investors tend not to short...). The big players sell overpriced shares to the retail investor, who is always late to the dance, and then there's no one left to buy--that's when prices drop and the retail investors sells his discounted shares back to the market makers.

Since this rally began, retail investors have largely bought bonds. They have generally avoided the market. This is generally a bullish sign as the last sucker is not yet in.

Very short term, that is in the last week and half, we had been waiting on a sharp move down followed by a day where the market gapped down lower and reversed to close positive. Once the euro went positive, we anticipated such a move. Instead, the market moved down even as the euro rallied. Given that the argument for a negative market was problems in the eurozone, this divergent movement was (and is) troubling. At this stage, we tend to believe that Thursday's downward movement was an overreaction to the euro situation (since it has since stabilized and moved up). The break in correlation in troubling and worth watching.

Speaking of the euro, frankly we've completely missed on most of our euro forecasts as many readers will likely duly note (they always remember the misses, but rarely the hits *sigh*). We anticipated a short to intermediate term fall in the euro back in November, but this has carried on further than we anticipated. As a result, the US dollar has rallied longer and stronger than anticipated. However, we think we've seen the technical indicator that matters, which unfortunately, was in front of our noses the entire time:

Above is a monthly view of the euro from its 2000 lows to present, along with a Fibonacci retracement overlay. When a market retraces from major lows to major highs ,it tends to stop at one of the key Fibonacci retracement levels, notably the 50% level (as Elliott Wave aficionados can attest to). Note on this monthly chart, which is just about the longest term chart one can analyze, the euro has pulled back from its lows of 121.10. IF the euro falls below that level, the bearish trend continues (and global markets will likely lock up again). IF the euro drops below 111.87, that would be extremely negative, and essentially spell the end of the euro currency. Critical support lies at the 117-118 level where the 150 and 200 month moving averages, respectively reside. In essence, assuming the euro holds at the 121.10 level (or worst case, 111.87), it would be putting in a major low.

Conversely, the US dollar is near it's 2008 highs. A break above the 89.68 level on a weekly basis would be very bullish. As is, the dollar appears dramatically overbought at this level.

We anticipate a rise in the euro to the 1.33-1.37 range, followed by a strong pullback to support. We will reevaluate it at that stage to determine how the dollar/euro currency game is running along. As long as the euro strengthens, global equity markets are likely to maintain some stability.

So, we have a mixed bag of evidence that we are inclined to interpret as follows: the big market crash is yet to come, and depending on how much liquidity the central banks of the world pump in to prevent a crash, may never come. Here are the most optimistic to most bearish cases for global equities:

The most optimistic case is that central banks ramp up liquidity again and equity markets move to new, sustained highs. This is the number one item to watch at this stage. Given that central banks are often behind the curve, we doubt that central banks will respond until a new crisis is underway. We're not really expecting this case to come to fruition.

The most bearish case is a crash that begins next week and moves to new lows. That is possible, and we are watching the S&P at the 1125 level for clues as to what's next. More on this in a bit.

We believe the most likely case is that equity markets will be held together for a few more months (3-6) as they generally start trading in a sideways range. Depending on the quantitative easing during that period, they will either move to new highs or begin a major correction of approximately 50% while central banks, who will likely be behind the curve, again turn on the printing presses.

What's most important is having signposts over the next few months that provide clues as to where we're headed in the intermediate term. For this, we will show some proprietary indicators and how they've performed in past market top situations.

First, you need to be able to understand the indicators. In addition to the well known indicators we often reference, like RSI, MACD, and stochastics, we rely on some cyclical, fractal, and volume-based indicators so that our analysis does not focus on momentum activities alone. By using several different, unrelated indicators over different timeframes, the likelihood of making right decisions increases dramatically.

First, let's look at a few wider period pictures of the key tops we're going to cover--just for reference. We begin with the 1930s.

Below is a daily chart of the DJIA from 1928-1931, the most feared crash period of them all, along with the 150 day moving average and volume.

The 1929 crash was a classic head and shoulders top. What was unexpected was that the crash occurred very quickly. As soon as the 150 day moving average flattened out, the market fell right through it. This is the crash scenario we're most concerned with, but it's not as common as most crashes. Note the behavior--until the crash occurred, the 150 day moving average served as support. After the crash, it served as resistance. Stay on the right side of the market. We cannot overemphasize this.

After the rally, the 1930 crash was less dramatic, but was the beginning of the long slide down. Note that during that rally and top, the 150 dma was already negative. That is not what we currently have in the S&P.

There was a rally in the middle of 1932 that fizzled over 9 months or so, then a bounce from a flat to rising 150 dma, ultimately culminating in a massive rally into July of 1933. The market moved sideways (setting up an inverse head and shoulders that was never activated) into the end of 1934.

The market recovered beginning in the spring of 1935. After a massive whipsaw from March to August of 1937, the market again crashed in September of 1937 in dramatic fashion. Again, the 150 dma was flat when the prices began to close under it--signaling a crash was on the horizon.

From 1938-1941, the market whipsawed frequently, with obvious technical patterns before major drops (a head and shoulders and a descending right triangle above).

While the 1930s were characterized by deflation, brought about by the discipline of the gold standard, the 1960s and 1970s were characterized by inflation resulting from the lack of discipline of being on the gold standard.

The inflationary 1970s secular bear market began in 1966. Again, note the similarity in market activity around the 150 dma.

For sake of brevity, we'll post the rest of the secular bear market in 3 year increments.

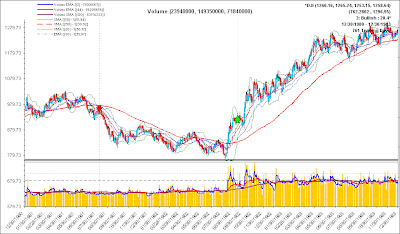

For reference, here is the latest 3 years from the top in 2007 to present.

In Part II we will look specifically at the years that contain the tops and compare them to today's situation.

Read more...